Wet Kindling

China and Crude Oil

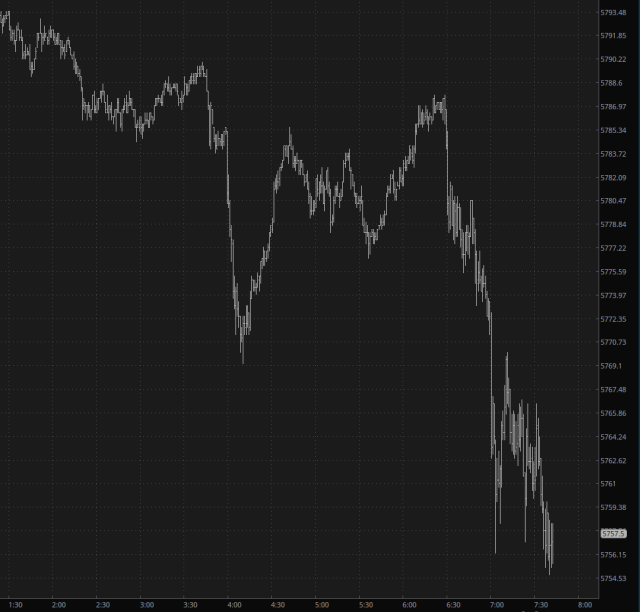

China blasted equity markets with a firehose of stimulus overnight, and although it worked great, producing the biggest gains in Asian equity markets in YEARS, the effects of it seem to be kind of short-lived. Since midnight, the /ES has been - - how to put this gently - - slipping away from its sugar high.

One particular area of interest to me are the commodities like copper and crude oil which went absolutely stratospheric on the news of China dumping hundreds of billions of yuan into the markets, in a desperate bid to prop up their collapsing real estate market and shriveling equity valuations.

As we look at our own DBC fund, which is a conglomerate of commodities, we have once again smashed up against the dashed red line I've drawn representing resistance. Those two pink tops represent formidable overhead supply, and with the proverbial cat out of the bag (that is to say, the big news from China), I'd say this "good" news has been fully taken into account.